are campaign contributions tax deductible in 2019

In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state-level candidate or Minnesota political party up to 50. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Asking For Donations Wording Matters Campaign Monitor

There will be a.

. Are charitable contributions deductible in 2019. Heres how the tax credit works. You choose the charities and the amount.

The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage usually 15 percent of the taxpayers aggregate net income or taxable income. State and local sales tax and other deductible taxes. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Savings bonds with a. Are Political Contributions Tax Deductible. The 2019-2020 contribution limit was capped at.

Contribution amounts are often limited and the contributions are not tax-deductible. The same goes for campaign contributions. To deduct the amount you tithe to your church or place of worship report the amount you donate to qualified charitable organizations such as churches on Schedule A.

No these bonds have stopp. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not included in their taxable income.

After years of public service federal retirees may want to continue giving. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Savings bonds with a face value of 35000.

For contributions of food inventory in 2020 business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate. Otherwise the donations are not exempt from donors tax and not deductible as a political contribution on the part of the donor. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations.

These bonds are 37 years old. The answer is no political contributions are not tax deductible. Charitable donations are tax deductible and the IRS considers church tithing tax deductible as well.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. The answer is no political contributions are not tax deductible. You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign.

And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. My uncle recently passed away and owned several US. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible.

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. This means that if you donate to a political candidate a political party a campaign committee or a political action committee these contributions will not be tax-deductible.

The information in this article is up to date through tax year 2019 taxes filed in 2020. During the 2019 campaign former Labor leader Bill Shorten further infuriated accountants by referring to the 3000 tax deduction limit for. The information in this article is up to.

Are campaign contributions tax deductible in 2019. The amount an individual can contribute to a candidate for each election was increased to 2800 per election up from 2700. Bookkeeping Typically deductible charitable contributions are those made to organizations that are tax-exempt under 501 of the Internal Revenue Code.

My uncle recently passed away and owned several US. Are these bonds earning any interest. The answer is no political contributions are not tax deductible.

The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to. For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers.

Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either. This stems from the presumption that campaign contributions are meant to be utilized by the candidate for his or her campaign and not for personal use and are thus not a proper inclusion to the candidates taxable income. Wrongfully claiming political contributions can and will attract the attention of the Internal Revenue Service and can lead to an assessment of additional taxes due penalties and interest.

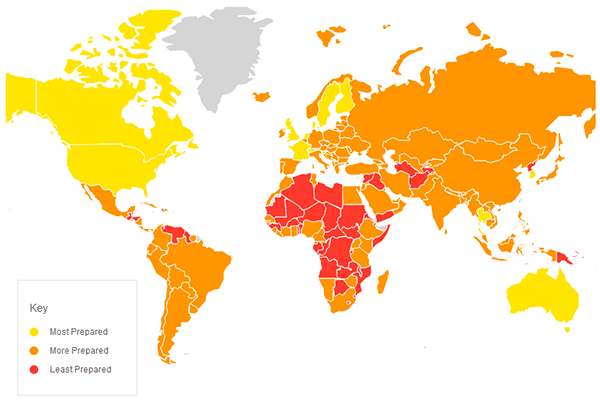

Why It Matters In Paying Taxes Doing Business World Bank Group

Are Political Contributions Tax Deductible H R Block

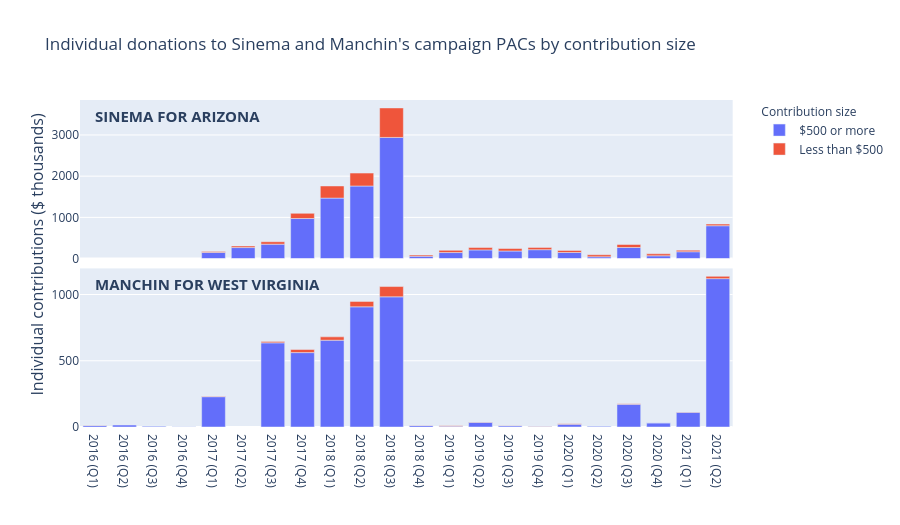

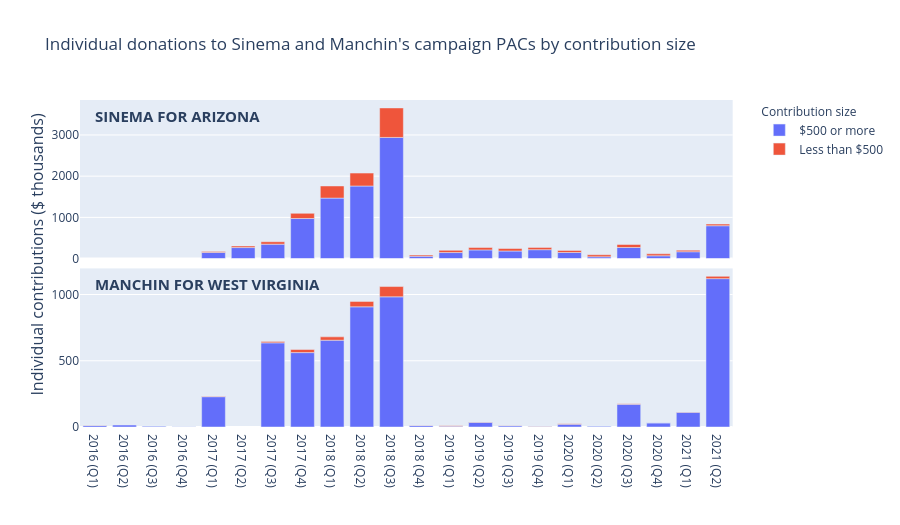

Sinema And Manchin Flush With Lobbyist Contributions As They Hold Up Biden Agenda

Why It Matters In Paying Taxes Doing Business World Bank Group

Supreme Court Eyes Rich Activists Their Anonymous Donations And Tax Breaks Npr

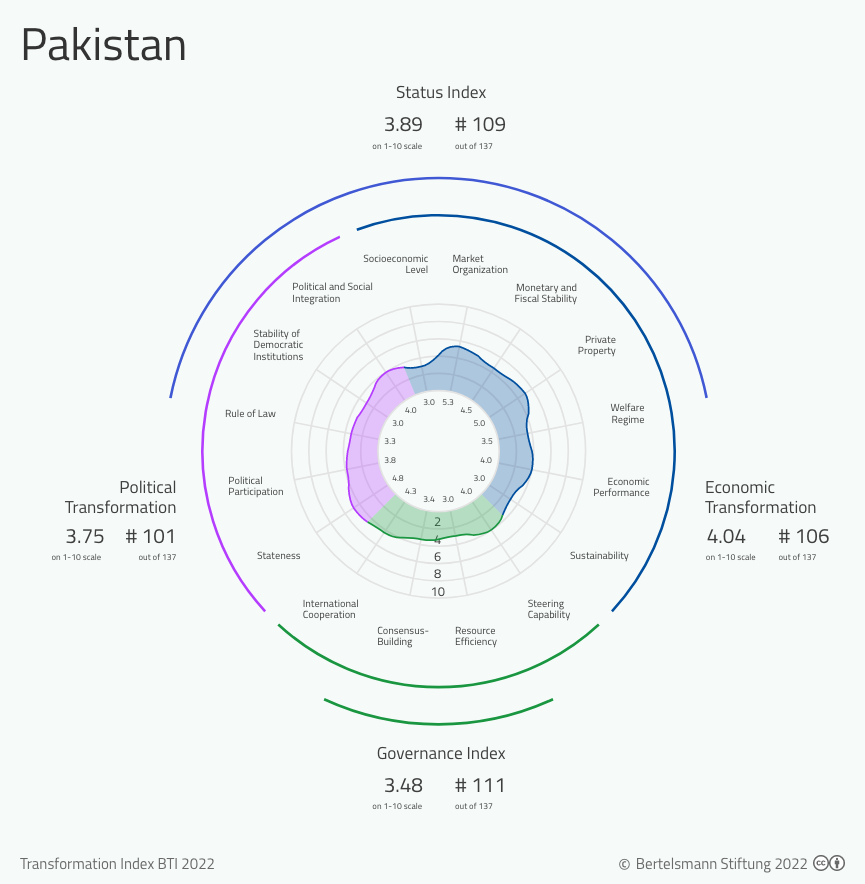

Bti 2022 Pakistan Country Report Bti 2022

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

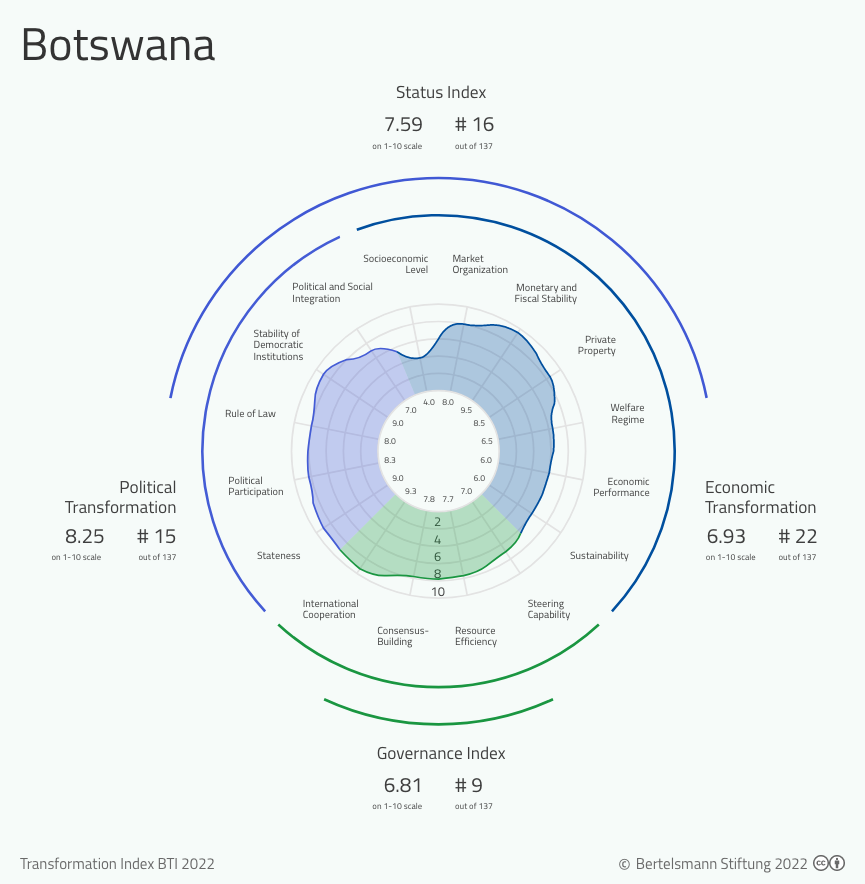

Bti 2022 Botswana Country Report Bti 2022

Are Political Contributions Tax Deductible H R Block

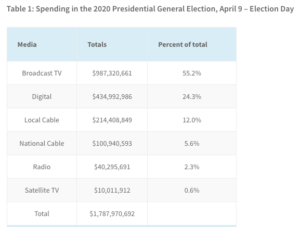

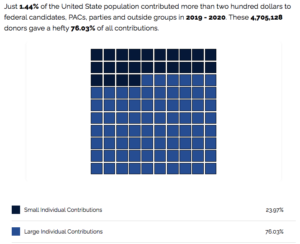

Campaign Finance The Policy Circle

Campaign Finance The Policy Circle

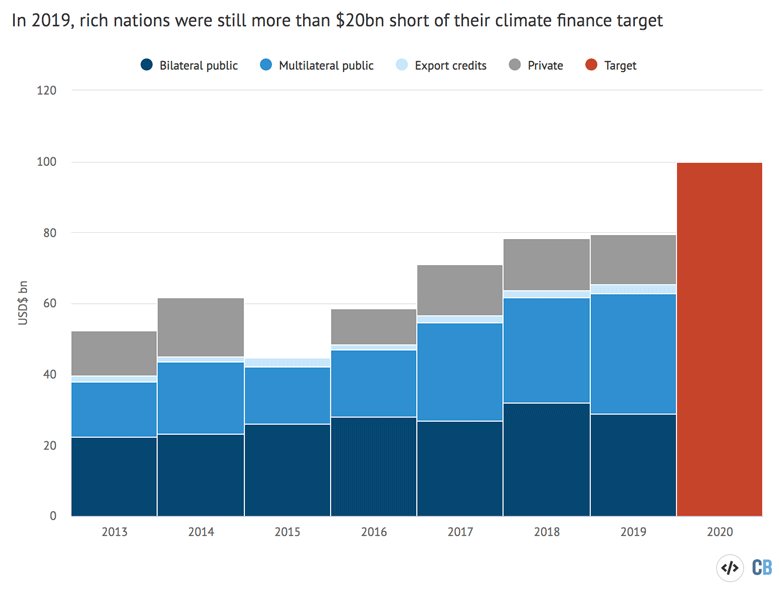

In Depth Q A What Is Climate Justice Carbon Brief

Here Are The Top Political Donors From Amazon Apple Facebook Google And Microsoft Only One Is Backing Trump Protocol

Covid 19 In Latin America Political Challenges Trials For Health Systems And Economic Uncertainty Real Instituto Elcano